Much has been written about bull market manias and their ability to draw capital to new ideas, but it’s bear markets where the real work is done. Despite their financial and psychological toll, bear markets are critical to furthering technical innovation and economic opportunity. The dissipation of hype surrounding a technology enables two specific forms of experimentation that ultimately broaden the adoption and utility of technology over the long term.

First, large enterprises and institutions experiment with the inventions of the previous cycle to understand if, and exactly how, they can commercialize the technology to drive improved business outcomes. Second, bold entrepreneurs assess the gaps in today's technical landscape and identify opportunities for net new, step-change innovation. The products that catalyze new adoption cycles are born when most have lost interest; this is where we are now in crypto.

This is a critical period of the market cycle, and it’s essential to remain focused on both the commercialization and innovation initiatives. We see tremendous potential for blockchain and crypto and believe more than ever in the potential for these technologies to change the world for the better. Many use cases are gaining meaningful traction, though they remain obfuscated by the fading veneer of negative headlines and politically motivated crusades.

But what are these real-world use cases? What are the applications that will get businesses and consumers to use this technology? This is precisely what we’re going to cover here. We aim to illustrate how crypto is already changing the world and how this technology will impact many industries over the next decade. But first, we will quickly touch on the unique value of the innovations that constitute web3 and the overall mission statement for the sector. For those who are already anointed degens or would prefer to skip ahead, here is a table of contents to help you get where you want to go.

Table of Contents

What We're Building For

Tokenization of Financial Assets

TradFi’s New Settlement Layer

Stablecoins and Payments and Remittances, Oh My!

DeFi Ain’t Dead

Tokenization of “Real World Assets”

A New Way To Collect

An Open Market for Intellectual Property

Tokenization of Loyalty Rewards

Verifiable Virtual Goods

The Business Model for Open-Source Software

Open Infrastructure Networks

AI & Crypto: Converging Megatrends

Protocols Are The Next Platforms

Parting Thoughts

What We’re Building For

Three core technical innovations enable web3: blockchains, smart contracts, and tokens. Blockchains are open, decentralized databases that create security through a distributed consensus mechanism. Smart contracts are software programs that can be autonomously executed on-chain. Lastly, tokens are a digital representation of data or assets registered on-chain.

Combining these technical innovations enables a new era of internet functionality, where the balance of power and ownership is more democratized. Web1, or the “Read Era,” enabled the world’s information to be aggregated and accessed by anyone with an internet connection. A decade later, Web2 emerged, known as the “Write Era,” where entrepreneurs built applications on top of the internet to enable users to publish new information and interact with each other around that information in unique ways.

We’re now gradually migrating to Web3, the “Own Era,” where the combination of blockchains, smart contracts, and tokens enables internet users to participate in its governance and economic upside. Democratizing access to ownership and governance provides key functionality the internet has lacked since its inception. Web3 also lays the foundation to restore privacy and prevent big tech from monetizing our identities and personal data.

The idea of democratized ownership represents a radical juxtaposition to the status quo in society today. Personal sovereignty and asset ownership are in secular decline. Home affordability is at multi-decade lows. The proliferation of subscription models has turned us into a society of perpetual renters of goods and services. Thanks to the oligopolies of Web2, namely META, Google, Amazon, and Microsoft, we no longer exclusively own our identities, as every data point about us is sold to the highest bidder. Instead of being the consumers of big tech, we are the products. Web3 offers an alternative to the dystopian surveillance state we’re approaching and will form the foundation for a multi-generational demographic shift back to asset ownership.

Blockchain technology is rebuilding trust with cryptography. This opportunity is attracting the minds of brilliant innovators, who are positing questions about how we do things and how these processes can be improved. Why is it so expensive for someone to send money to their family overseas? How can we enable broader ownership of assets? We can trade Bitcoin and Ether twenty-four seven, so why not equities? Why is our data available to be purchased by the highest bidder? Why must we trust businesses that eschew transparency and leverage opacity to monetize users? These are only a few examples of what operators are building for and, more importantly, what’s at stake.

Tokenization of Financial Assets

TradFi’s New Settlement Layer

One of crypto's most enduring bear market memes is “The institutions are coming.” Well, don’t call it a comeback because the tokenization era has arrived. Financial institutions have been tinkering with web3 for nearly a decade, and we’re now finally tokenizing assets en masse and tracking them on a blockchain.

The combination of decentralized databases, smart contracts, and tokenization enables frictionless settlement for financial markets, which are currently running on decades-old systems. The improved efficiencies from asset tokenization provide several secondary benefits to financial institutions, such as reduced credit risk; lower settlement, financing, and operational costs; increased liquidity for previously illiquid assets; and more efficient capital allocations.

The adoption of asset tokenization is expanding quickly across financial market participants as the efficiency gains become more evident:

JP Morgan announced it’s building a blockchain-based “deposit token” to streamline cross-border payments and settlements. JP Morgan believes deposit tokens could become a widely used form of money within the digital asset ecosystem, similar to how commercial bank deposits represent >90% of circulating money today.

Citi recently issued a tokenized letter of credit, decreasing processing time to 3 hours from 5-10 days.

The EIB issued a tokenized €100m bond with a T+0 settlement.

KKR and Hamilton Lane tokenized private equity funds to reduce minimum investments to $10k-100k from $5m.

Broadridge’s DLT platform settles more than $1 trillion monthly of tokenized repos.

Franklin Templeton leaned into the cost savings of tokenization by launching a tokenized money market fund that uses a blockchain as a digital transfer agent and settlement layer. Franklin Templeton’s U.S. Government Money Market Fund is currently leading the pack in this product category, with around $300 million under management.

We’re ultimately in the early innings here; the $630 million currently on-chain represents ~0.00012% of the roughly $500 trillion in assets held by the financial sector. But what we’re seeing today is meaningful – large financial institutions are putting client funds into on-chain financial products. BCG believes we’ll have $16 trillion of tokenized assets by 2030, an estimate we feel could be on the conservative side; but regardless, the products launched by institutions this year represent a massive step forward towards bringing the world’s financial assets on-chain.

Stablecoins and Payments and Remittances, Oh My!

One of crypto’s most ambitious initiatives is tokenizing the world’s reserve currency, the United States Dollar. By tokenizing USD in digitally native form on global blockchain rails, we enable cheap, instant, and programmable value transfer across borders for consumers and merchants. In just a few years, USD stablecoins have caught on like wildfire, with more than $125 billion in circulation and more than $7 trillion of transactions settled annually on public blockchains.

Stablecoins are big business, with an extensive global profit pool available to market participants. Leading issuer Tether has publicly stated a quarterly “operational profit” of $1 billion, and Circle, the second largest stablecoin issuer, reported $779 million in revenues for H1 2023, surpassing its FY 2022 revenue of $772 million. Remember that stablecoins are still relatively isolated to the crypto economy and have yet to penetrate mainstream payments and commerce markets.

This is rapidly changing thanks to the technical advancement of blockchains in recent years. Select blockchain platforms, like our portfolio company Solana, can now directly compete against or even partner with centralized payment rails to process transactions. In a recent partnership, Visa announced it is expanding its blockchain settlement program to Solana. Here’s an excerpt from Visa’s press release:

“As Visa looked to expand this capability to additional clients, there has been significant demand to leverage newer, high performance blockchains that can send and receive stablecoins with higher speed and lower costs. For these reasons, Visa chose to add support for Solana as a high performance blockchain that its partners can choose to send or receive USDC settlement payments.”

Visa is currently in live pilots with issuers and acquirers, moving millions of stablecoin USDC (issued by Circle) over the Solana and Ethereum blockchain networks to settle fiat-denominated payments. The payment settlement process, where Visa’s settlement and treasury systems move funds from the purchaser's bank (issuer) to the merchant's bank (acquirer), is being made faster and cheaper by the Solana blockchain.

This is also a win for the acquirers. Worldpay, one of the largest merchant acquirers in the world and a launch partner with Solana and Visa, claims this initiative will allow them to bring more of their treasury operations in-house while providing merchants with more choices for receiving funds.

Visa isn’t the only payment giant moving into crypto. Paypal recently introduced its branded stablecoin, PayPal USD ($PYUSD), a 1:1 USD-backed stablecoin that will be the only stablecoin available in the Paypal and Venmo apps. PayPal USD will act as a bridge, enabling consumers, developers, and merchants to seamlessly move between fiat and digital currencies. Many use cases in web3 will benefit from this frictionless payment experience, such as in-game purchases, micropayments to creators and developers, and brand royalty streams.

The largest payment companies in the world are now recognizing and embracing the power of stablecoin payments on global blockchain networks. We’re in the early innings of the global adoption of blockchain-based payment systems, but we have high conviction that this will be a bright spot for the sector in the coming years.

DeFi Ain’t Dead

The benefits of crypto’s shared settlement and open-source software model are best exemplified by Decentralized Finance (DeFi). The protocols of DeFi are programmed to offer novel mechanisms for delivering financial market functionality, such as exchanging assets, borrowing against your assets, and staking your assets.

The open-source nature of DeFi protocols, combined with the fact that they run autonomously on a public blockchain, ensures that protocols will behave exactly as expected, regardless of the market conditions. For example, in 2022, while centralized finance (CeFi) market participants like Celsius, Voyager, and BlockFi were faltering because of liquidity issues, Aave and Compound, the two most prominent lending protocols by total value locked (TVL), continued to function seamlessly without interruption.

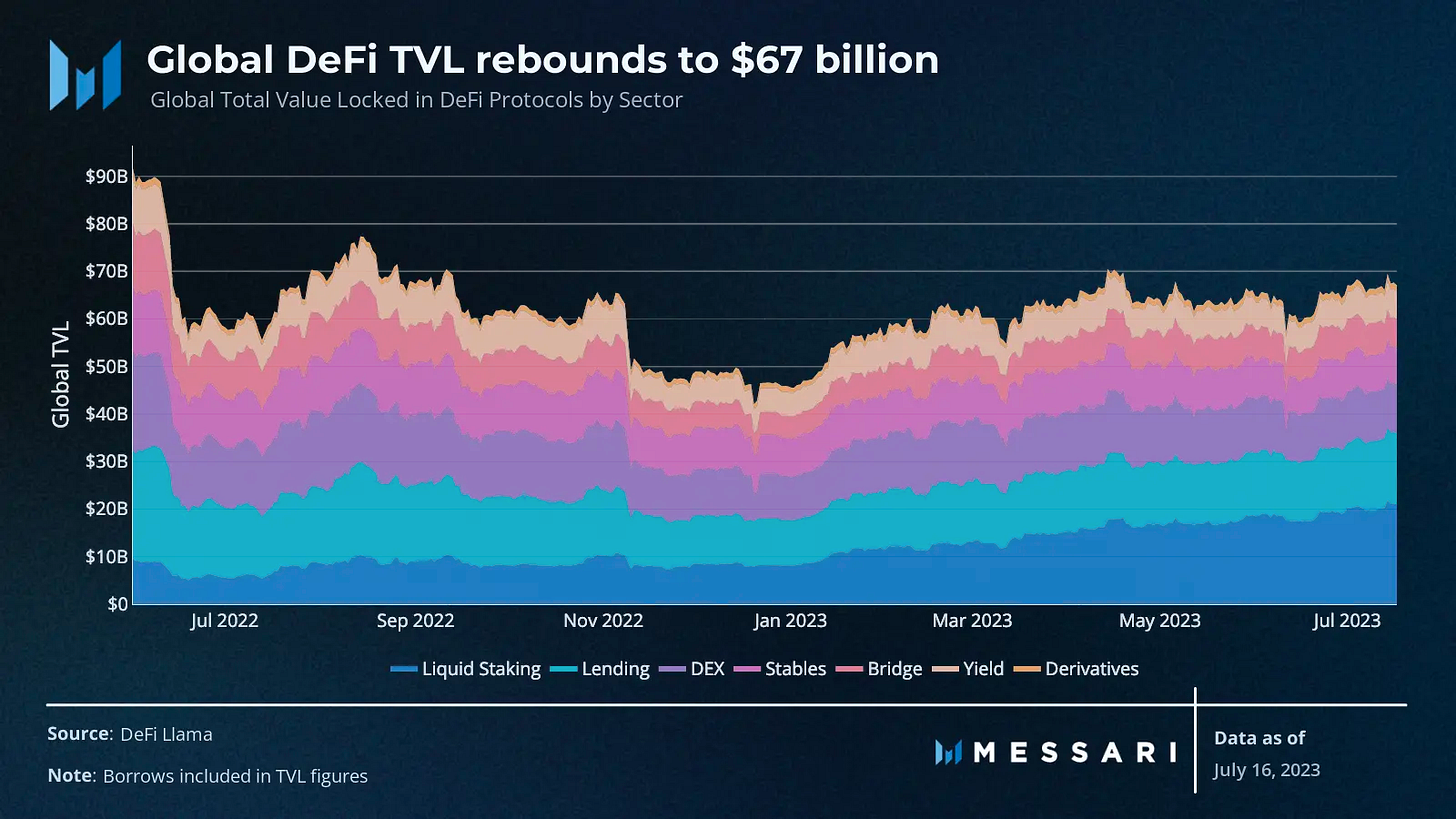

Despite last year’s market volatility and the stigma around DeFi, the sector is still alive and well. Of course, all numbers are down relative to the peak bull market conditions of 2021, though total value locked (TVL) in DeFi rebounded early in 2023 and has resumed a modest uptrend.

Much of this year's growth has been driven by the rising popularity of liquid staking in the wake of Ethereum’s recent Shapella upgrade – and the fees are significant! Over the last thirty days, the leading liquid staking protocol, Lido, generated $50m in fees, followed by the most prominent decentralized exchange, Uniswap, with $37m in fees, and stablecoin issuer MakerDAO, with $16m.

Keep in mind the fee environment in DeFi is highly competitive. The near-instant settlement capabilities of modern blockchains enable what might be considered the highest-velocity liquidity environment in the world. The lack of friction surrounding the capital in DeFi means competition for liquidity is cutthroat, leading to constant fee compression and experimentation with novel incentive structures.

Competition ultimately benefits the user, who can now access low-cost, deep liquidity without trusting a centralized service provider like Celsius or Silicon Valley Bank. In the wake of this year’s banking crisis, the value propositions of DeFi have never been more explicit. Decentralized Finance offers an alternative to blindly trusting banks with your savings and assuming they know how to manage risk appropriately. This is a massive tailwind for the entire crypto space, specifically the DeFi sector.

Tokenization of “Real World Assets”

The value proposition of tokenization extends beyond the world’s financial assets to real assets, often referenced in this context as ‘real world’ assets (RWAs). Assets across real estate, art, wine, luxury watches, corporate supply chains, intellectual property rights, and vehicle titles, just to name a few examples, are currently being tokenized on-chain. The basic tenet of cost savings still stands here; blockchains and tokenization generally provide a more cost-effective method for issuing, tracking, and managing assets. However, in some cases, asset tokenization can completely reshape an industry's operations.

A New Way To Collect

The high-end wine market is a great case study, where producers leverage NFTs to create digital representations of allocations in new vintages. Luxury winemakers are leaving an estimated $75 billion per year on the table because they don’t have a direct relationship with consumers and lack visibility into the global supply chain. Issuing a digital representation of each bottle on a unified ledger streamlines an antiquated and cumbersome supply chain of disparate service providers while guaranteeing reliable provenance.

In addition to providing a more effortless user experience and reducing fraud, digitization enables new interaction between the producer and consumer. Thanks to the NFT, producers can get greater visibility into the collecting habits of buyers, making it easier to offer special perks and experiences to the most loyal customers. dVIN is the best example of this product strategy in today's wine market.

dVIN is a blockchain-based “operating system” that helps luxury winemakers capture better economics by cutting out middlemen. Top winemakers use the dVIN app to tokenize and distribute small allocations in current or library vintages of their wine. Consumers who participate in the wine drops receive an NFT representing the bottles purchased and can choose to warehouse the wine or take delivery.

By enabling a direct connection between the producer and consumer, dVIN turns a fragmented spiderweb of disparate service providers into a digitally-native network. Producers can leverage this connectivity to form stronger consumer relationships and a better understanding of what their audience cares about. Thanks to this elevated understanding of consumer preference, wine producers can offer hyper-tailored loyalty programs to their best customers. It’s also helpful in creating high-conversion campaigns to attract net new buyers in similar or tangential demographics.

Wine is just one example of how the collecting experience is evolving. Beyond wine and other classes of physical collectibles, the benefits of blockchain-based tokenization are being leveraged by creators across all disciplines and mediums.

An Open Market for Intellectual Property

Tokenization will spawn entirely new markets that were previously inaccessible to all but a few private equity firms and corporations. Music catalogs have become an acquisition target for institutional investors who believe the royalty streams present an attractive cash flow opportunity relative to the current valuation. For example, Universal recently purchased Bob Dylan’s publishing catalog for an estimated $300-400m, and Sony acquired his master recordings for an estimated $200m. A UK-based investment firm, Hipgnosis, recently acquired Justin Bieber’s pre-2022 music for $200m.

What if anyone could invest in the music of their favorite artist? With NFTs, this is now possible. In May 2022, the hit electronic music duo The Chainsmokers distributed 5,000 NFTs to their top fans that entitled holders to 1% (0.0002% per NFT) of master streaming royalties generated from their album “So Far So Good.” Shortly after its success, fellow chart-topping artists The Weeknd, Nas, Diplo, Martin Garrix, and many others joined in distributing similar NFTs.

Over the long term, this will enable artists to finance future projects alongside their biggest fans, reducing reliance on the traditional studio model to cover the upfront production costs. In addition to ownership in the project, fans can unlock additional perks for their contribution, such as access to special events, backstage passes, and signed merchandise. This inverts the traditional business model for music production, where IP is now sold and financed upfront directly by the artist’s fanbase instead of through the record label.

Tokenization of Loyalty Rewards

We often see value propositions that go beyond cost savings by opening new revenue opportunities. We have seen a tidal wave of corporate experimentation with non-fungible tokens (NFTs) over the last 18 months, with more than 150 companies launching ~250 NFT collections in 2022 alone. The top ten corporate NFT issuers generated ~$265m in revenue from primary sales and royalties on secondary market sales.

Nike has pioneered leveraging blockchain and tokenization to engage its audience in novel ways. Nike’s most recent foray into the space was its airdrop of NFTs called “Our Force 1” (OF1) to members of its .SWOOSH web3 collectibles platform. OF1 assets are designed to act as collectible poster art, but ownership also unlocks “unique benefits” like special access to future physical products, in-person experiences, and more.

The next phase of Nike’s strategy is to bring their virtual goods to the online worlds where their target audience already spends hours per day. After the launch, Nike announced a partnership with EA Sports, where it’s speculated that the .SWOOSH platform will be integrated with EA games, enabling users to buy Nike NFT collectibles as wearable add-ons for their in-game characters. Taking this initiative further, Nike recently became one of the first brands to build an immersive world within Fortnite, where players could go on in-game treasure hunts for Air Max sneakers. Although Nike’s virtual business is still in its infancy, early data shows significant promise, generating $186m in revenue since inception in 2022.

Roblox, Fortnite, and Minecraft are the leading platforms representing what the metaverse is today, with a combined 600m+ monthly active users. Gartner estimates that by 2026, 25% of people will spend an hour or more in the metaverse daily, but for now, the younger generations are helping virtual worlds thrive. Roughly 83% of metaverse users today are 18 years old or younger, an audience brands desperately want to target, which we believe is a massive secular tailwind for loyalty strategies at the intersection of digital assets and virtual worlds.

Verifiable Virtual Goods

In parallel with the above efforts, there is currently a burgeoning young industry of crypto-native game studios, such as Immutable, Animoca Brands, and Yuga Labs. The companies in this sector are building games that leverage crypto protocols from the ground up to offer unique experiences. A significant differentiator of web3-native games is how prevalent and critical various digital assets are to the gameplay experience and progression.

For web3-native games, any in-game object worth owning can be represented by an NFT, whether a spaceship in Star Atlas, race horses in Photo Finish Live, or trading card packs in God’s Unchained. In these experiences, NFTs are integral to participation in the game, and in many cases, you can’t play the game without purchasing an in-game NFT asset. Economic models for web3 games are evolving based on the failure points of early gaming tokens.

Our portfolio company, Third Time Entertainment, the developer of Photo Finish Live, has struck an elegant balance between ownership, earning potential, and overall gameplay experience. This combination has helped Photo Finish Live develop an impressive amount of traction.

Photo Finish is an excellent example of how studios prioritize user experience and retention over upfront monetization. The game utilizes a stable in-game currency called $DERBY to facilitate all commerce, such as buying and selling horses, entering races, wagering on races, and breeding horses. Additionally, Photo Finish has made it easy to buy $DERBY with Circle’s USDC stablecoin or directly through your wallet. We expect more games to follow their lead in providing a more “web2” user experience to provide a smoother onboarding flow and gameplay experience.

The Business Model for Open-Source Software

Crypto has introduced a novel use case for tokens beyond simply tokenizing existing financial or tangible assets, and that is to incentivize the development and maintenance of open-source software. Historically, open-source software would be managed by a foundation and supported by volunteers who contribute because they’re passionate about the technology.

Despite being highly valuable to society, open-source projects often fail to capture economic rewards. Email is a prime example of this from Web1. SMTP is the underlying open, permissionless protocol that enables email-based online communication. Although SMTP is the ubiquitously adopted standard, the economic value from email accrues to the handful of companies that operate email clients on top of it, like Microsoft and Google.

In other cases, the commercialization of open-source has come from for-profit companies that build and sell enterprise solutions leveraging the core technology. Red Hat and Linux are commonly referenced examples of how this dynamic has played out. Linux is an open-source operating system managed by a non-profit foundation called the Linux Foundation. Red Hat is a for-profit business that handles commercial implementations of the Linux OS. There is a path to success here; after all, IBM purchased Red Hat for $34 billion in 2019.

The problem with this model is that it fails to effectively incentivize the 30 million software developers worldwide to contribute to open-source software regularly. Herein lies the power of open-source protocols with native tokens; they have an incentive structure that’s intrinsically tied to the network's success. When a developer in crypto contributes to an open-source network, they are rewarded with grants and bounties in the network’s native token. If the network achieves a Linux OS level of success, the early supporters of the open-source network will share in the economics of that achievement. This model has driven the explosive success of Bitcoin, Ethereum, Solana, The Graph, and many other web3 protocols.

The best part about this system is that it’s entirely open and unencumbered by the traditional constraints of a corporation or foundation. Anyone, anywhere in the world, at any time, can contribute code to the network. This system is a pure and meritocratic embodiment of free market capitalism for open-source software. We are in the earliest days of utilizing token incentives as a business model for open-source software, but winning models are beginning to emerge from the pack.

Open Infrastructure Networks

Token incentives enable large-scale coordination. This superpower is now utilized to attract and coordinate large-scale physical infrastructure, such as the computing, storage, and bandwidth required to deliver various Internet services. Messari recently coined this category of web3 innovation as Decentralized Physical Infrastructure Networks, or “DePIN” for short.

DePINs leverage token incentives to crowdsource the physical infrastructure required to deliver the service defined by their protocol. In exchange for providing this infrastructure, network participants receive token rewards and a revenue share of fees paid to the protocol. Token rewards compensate the earliest adopters who support the network before it has customers or revenue.

The Graph is a perfect example of this in practice. The Graph’s protocol specifies exactly how blockchain data needs to be indexed by network participants, and anyone, anywhere in the world, can join the network to deliver indexing as a service by providing the requisite physical infrastructure. In exchange for providing that service, the network participant is compensated in The Graph’s native $GRT token and a share of the fees that applications pay to use the service. The Graph and fellow Reciprocal portfolio company Ceramic, a data storage protocol, are classified as “Server Networks,” attempting to unbundle specific products from the $569 billion Cloud Services industry.

Another great example is Helium, a Wireless Network DePIN disrupting the $1.8 trillion Telecom Industry. In 2019, Helium used token incentives to bootstrap a LoRaWAN network of over 900,000 hotspots operating across 182 countries, forming the largest IoT network in the world. Nova Labs, the company building Helium, recently announced that it intends to replicate this strategy and use token incentives to add coverage of additional types of telecom networks, including 5G, WiFi, VPN, and CDN.

The long-term mission of DePINs is to offer a higher quality of service than incumbents at a lower cost to the consumer. This begs the question, what other industries are dominated by oligopolies ripe for disruption?

AI & Crypto: Converging Megatrends?

Crypto and Artificial intelligence (AI) are two secular megatrends that have recently begun to converge. We envision many ways the two technologies could complement one another. Still, the global GPU shortage has recently driven the most urgent need for open infrastructure networks.

The idea is to use the DePIN playbook for crowdsourcing latent GPUs worldwide, providing lower-cost access to compute with improved flexibility around service levels. Several projects are currently attempting to bridge this gap, and they have been able to bootstrap the network's supply of GPUs effectively. On-boarding GPUs to the network is the first and arguably more straightforward step. Next, they must sell this GPU capacity as a viable alternative to platforms like Lamba Labs, CoreWeave, and Big Cloud. It’s still early days for the projects in this category, so traction and performance data are limited.

The value proposition we’re most excited about at this intersection is crypto’s ability to enable verifiable data and content. By leveraging the blockchain’s capacity as an open backend, we can track the origin and provenance of on-chain data and digital intellectual property to verify authenticity. The rise in AI-generated content and rapid improvement in its realism is something we should all fear. Our ability to discern real from fake on social media is already compromised, but it can and surely will get worse. I recently saw a video of a burning car generated by Unreal Engine that was virtually indistinguishable from reality if not for the designer moving a three-dimensional cursor through the car.

It’s easy to see how this could get out of hand quickly. In the best case, we spend too much on products we don’t need because of AI-generated social media ads. Worst case, AI-generated content is fed into highly effective misinformation, propaganda, and psychological warfare strategies between nation-states.

Fortunately, the blockchain’s ability to track and verify digital provenance can help solve this problem. Cryptographic identifiers, like digital signatures or fingerprints, can be added to content by the creator and stored on-chain. As the content is used, shared, and recirculated around the web, publishers can verify the content for authenticity by referencing its on-chain digital signature.

The teams at Arweave and Bundlr are already working on a solution for this with their Digital Content Provenance Record (DCPR) standard. Per Arweave’s Github, DCPR “offers a method for providing cryptographically verifiable provenance to individually identified items of data.” It’s encouraging to see large projects working on a solution for this problem, but it will take a significant go-to-market effort to gain adoption of this new standard.

Protocols Are The Next Platforms

The open infrastructure and token incentive strategies pioneered by DePIN are being leveraged to disrupt industries beyond Cloud Services and Telecommunications. The multi-sided marketplaces and platforms of web2 are highly exposed to web3 disruption in the coming years. Jeff Bezos famously said, “Your margin is my opportunity.” The token incentives of web3 can potentially push this ethos to its logical extreme beyond the capabilities of a single centralized company.

Web3 enables cost centers, or the supply side of multi-sided marketplaces, to be crowdsourced to those willing to perform a job or contribute a resource at a lower cost or profit. Wherever Capex or Opex arbitrage is possible through the coordination of disparate market participants, web3 will have an opportunity to be disruptive.

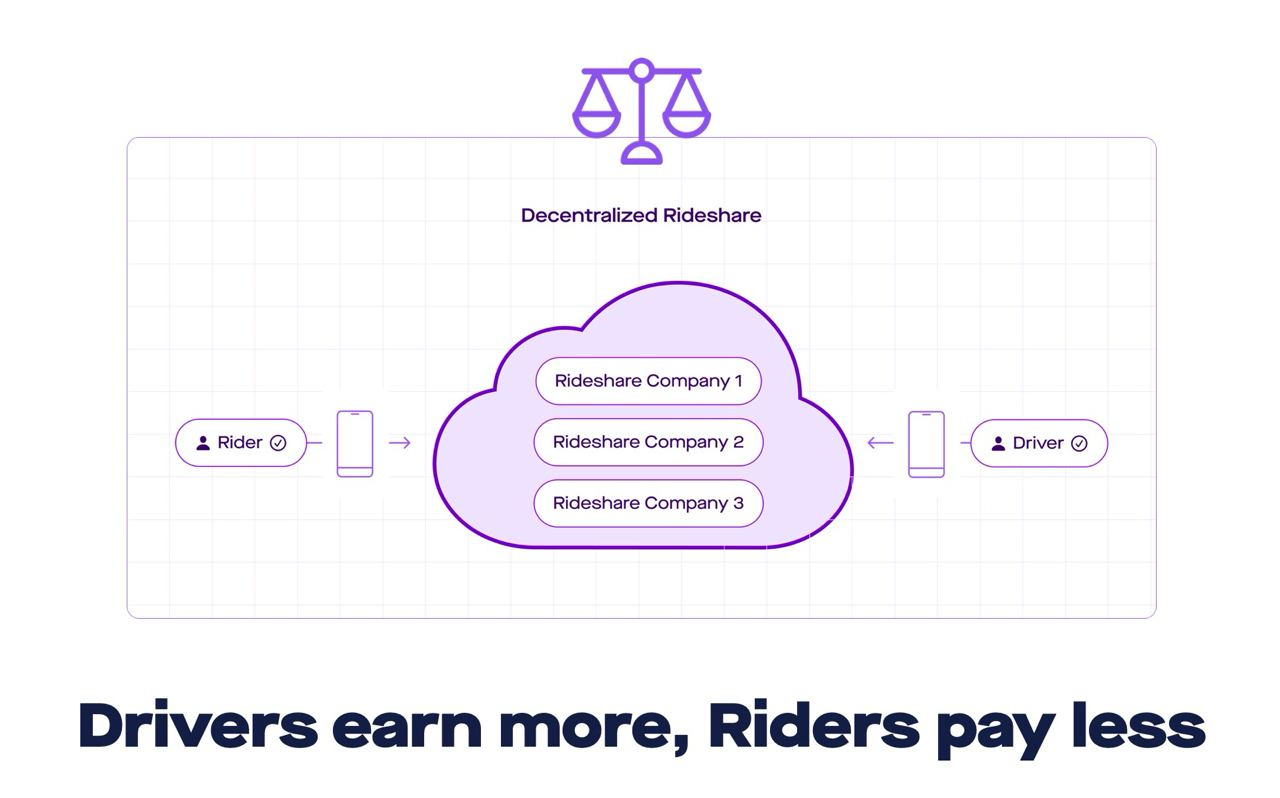

The sharing economy is one example of this trend in action. Uber forever changed the transportation market by turning every car owner into a potential taxi driver. Teleport is creating a protocol that enables anyone with a car and internet connection to operate their own Uber. Teleport’s TRIP protocol will standardize the core functionality of the Uber application, such as the pricing algorithm, the geolocational ride-matching system, and the payment processing functionality.

On a protocol like Teleport, rather than drivers operating as contract workers for Big Tech, they become small business owners who take the lion’s share of fees. In addition to fees, governance of the protocol is controlled by the drivers who contribute to the network’s success. This model represents a paradigm shift in labor markets, where contributors can gain ownership and governance of the platform they’re helping to build.

Parting Thoughts

In this essay, we covered many use cases for blockchain technology that are already approaching product market fit, but there’s also a lot we left out. A global community of developers, growing larger and stronger by the day, is building new and innovative products that can change the world. Companies are on the verge of revolutionizing digital identity with blockchain-based credentials, rebuilding capital markets with the next generation of exchange, and reshaping the playbook for bootstrapping a network of scarce resources.

Like those that came before it, this bear market has only hardened crypto protocols and the developer ecosystem behind them. We firmly believe the products built by this wave of entrepreneurs will improve the world, and we will be here to fund and support these builders. As a firm, we’re more excited about the opportunity for this sector than ever – as we speak, trillions of dollars in market opportunity are being pursued by entrepreneurs and corporations.

The widescale global adoption of this technology is no longer a question of if but when. At Reciprocal, we continue to forge ahead in supporting the bold entrepreneurs carrying this sector forward and building novel use cases into existence. We are interested in investing in all the categories highlighted in this paper and are always open to learning about new ideas. Please contact me on Twitter if you’re building in the space or brainstorming ideas for using web3 rails.

Special thanks to everyone who helped provide thoughts, guidance, and feedback on this post, especially Mert Mumtaz, Tegan Kline, Ben Sparango, Ian Cummings, Paul Bohm, Mike Steinberg, Ali Sheikh, and Steve Feldman.

Disclosure: Unless otherwise indicated, the views expressed in this post are solely those of the author(s) in their individual capacity and are not the views of Reciprocal Ventures Management, L.L.C. its affiliates (together with its affiliates, “Reciprocal”). Certain information contained herein may have been obtained from third-party sources, including from portfolio companies of funds managed by Reciprocal. Reciprocal believes that the information provided is reliable but has not independently verified the non-material information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. This post may contain links to third-party websites (“External Websites”). The existence of any such link does not constitute an endorsement of such websites, the content of the websites, or the operators of the websites. These links are provided solely as a convenience to you and not as an endorsement by us of the content on such External Websites. The content of such External Websites is developed and provided by others and Reciprocal takes no responsibility for any content therein. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in this blog are subject to change without notice and may differ or be contrary to opinions expressed by others.

The content is provided for informational purposes only and should not be relied upon as the basis for an investment decision, and is not, and should not be assumed to be, complete. The contents herein are not to be construed as legal, business, or tax advice. You should consult your own advisors for those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by Reciprocal, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results.

Past performance does not guarantee future results. There can be no guarantee that any Reciprocalinvestment vehicle’s investment objectives will be achieved, and the investment results may vary substantially from year to year or even from month to month. As a result, an investor could lose all or a substantial amount of its investment. Investments or products referenced in this blog may not be suitable for you or any other party.

The content speaks only as of the date indicated. This presentation contains “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results may differ materially and adversely from those reflected or contemplated in the forward-looking statements.

Reciprocal has established, maintains and enforces written policies and procedures reasonably designed to identify and effectively manage conflicts of interest related to its investment activities.

* This blog/research does not constitute investment advice or an offer to sell or a solicitation of an offer to purchase any limited partner interests in any investment vehicle managed by Reciprocal. An offer or solicitation of an investment in any Reciprocal investment vehicle will only be made pursuant to an offering memorandum, limited partnership agreement and subscription documents, and only the information in such documents should be relied upon when making a decision to invest.*

* Case studies are intended to provide examples of the types of transactions Reciprocal pursues and do not represent all investments made by Reciprocal or the outcomes achieved. Investment rationales and other considerations are based on Reciprocal’s internal analysis and views as of the date of the investment commitment and will not be updated. References to a particular investment should not be considered a recommendation of any security or investment. There can be no assurance that Reciprocal will be able to invest in similar opportunities in the future or that the investment shown is or will be successful.*